ESOP (Employee Stock Ownership Plan) Financing Overview

Long Point Capital Offers ESOP Financing

Long Point is the leading private equity firm providing ESOP financing. We have made investments in six companies owned 100% by ESOPs. We have the expertise to provide a financing solution to your new or existing ESOP company. We will provide smart junior capital for the following ESOP transactions:

- New ESOPs

- If you are planning to sell your business to a newly formed ESOP, we can furnish the capital to provide you more liquidity and wealth diversification than a traditional ESOP. See below for “Wealth Diversification”.

- Partial ESOPs

- If your Company is partially owned by an ESOP, you probably know the value of getting tax-free proceeds through a 1042 rollover. What you may not know is that potentially the best way to get more tax-efficient liquidity is to sell the balance of your ownership to an ESOP. We can show you why this may be your best liquidity alternative, and we can provide the capital to help you achieve complete liquidity.

- Mature ESOPs

- Maybe your ESOP has significant repurchase obligations that are causing cash flow concerns. Maybe you are concerned about your employees’ retirement funds being all in the same basket (your stock) and you would like to provide them some diversification. We can provide the capital to address and solve these common issues of mature ESOPs.

Wealth Diversification

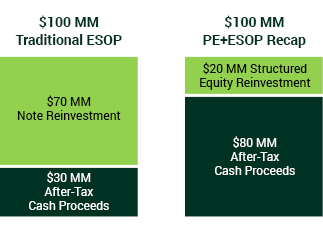

Long Point Capital invests the capital that provides significantly more wealth diversification for a business owner. In a “Traditional ESOP” transaction, a newly established ESOP borrows money through a senior bank loan, and purchases the Company from a business owner for proceeds consisting of cash (generated from the bank loan) and a seller note from the Company. Often, the cash only represents 30% to 40% of the proceeds.

In a private equity backed ESOP transaction (which we call a PE+ESOP Recap), the business owner can receive 80% or more of his proceeds in cash. The chart below shows the wealth diversification generated through a Traditional ESOP transaction, and through a PE+ESOP Recap. If one of your primary goals is wealth diversification, the PE+ESOP Recap allows you to achieve that goal more effectively than a Traditional ESOP. Please review the PDF's provided under "Additional Information/Publications" on this page, for more information.

Recent ESOP Transactions